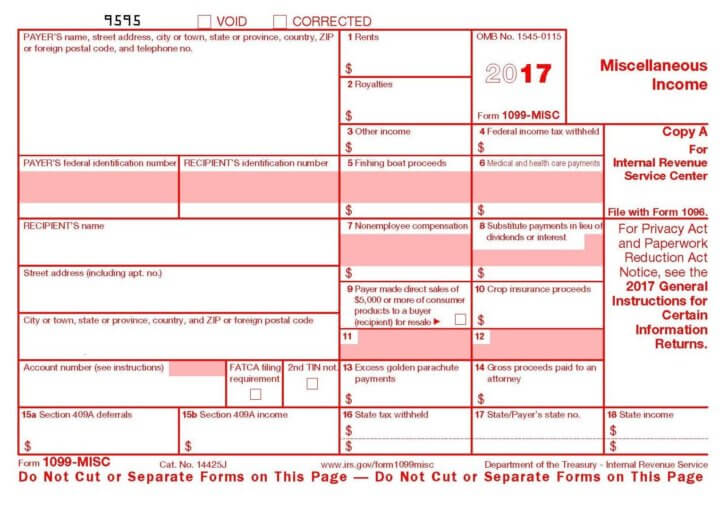

Form 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wagesA form 1099C falls under the 1099 tax form series of information returns These forms let the IRS know when you have received income outside of your W2 income Any company that pays an individual $600 or more in a year is required to send the recipient a 1099 You are likely to receive a 1099C when $600 or more of your debt is dischargedAnswer (1 of 3) The 1099NEC is the form that the payer uses to report nonemployee compensation paid to an individual Schedule C is the form that the recipient uses to report that compensation, plus any other income received for doing the same work On Schedule C, you enter your income and the

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

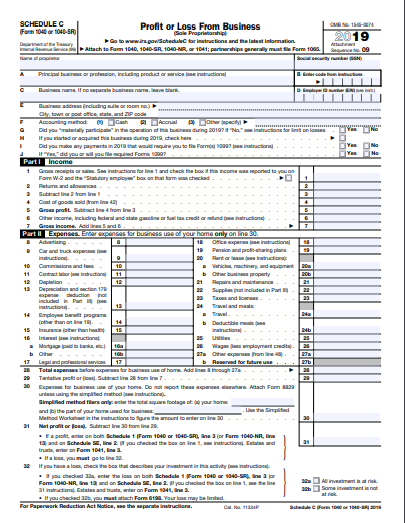

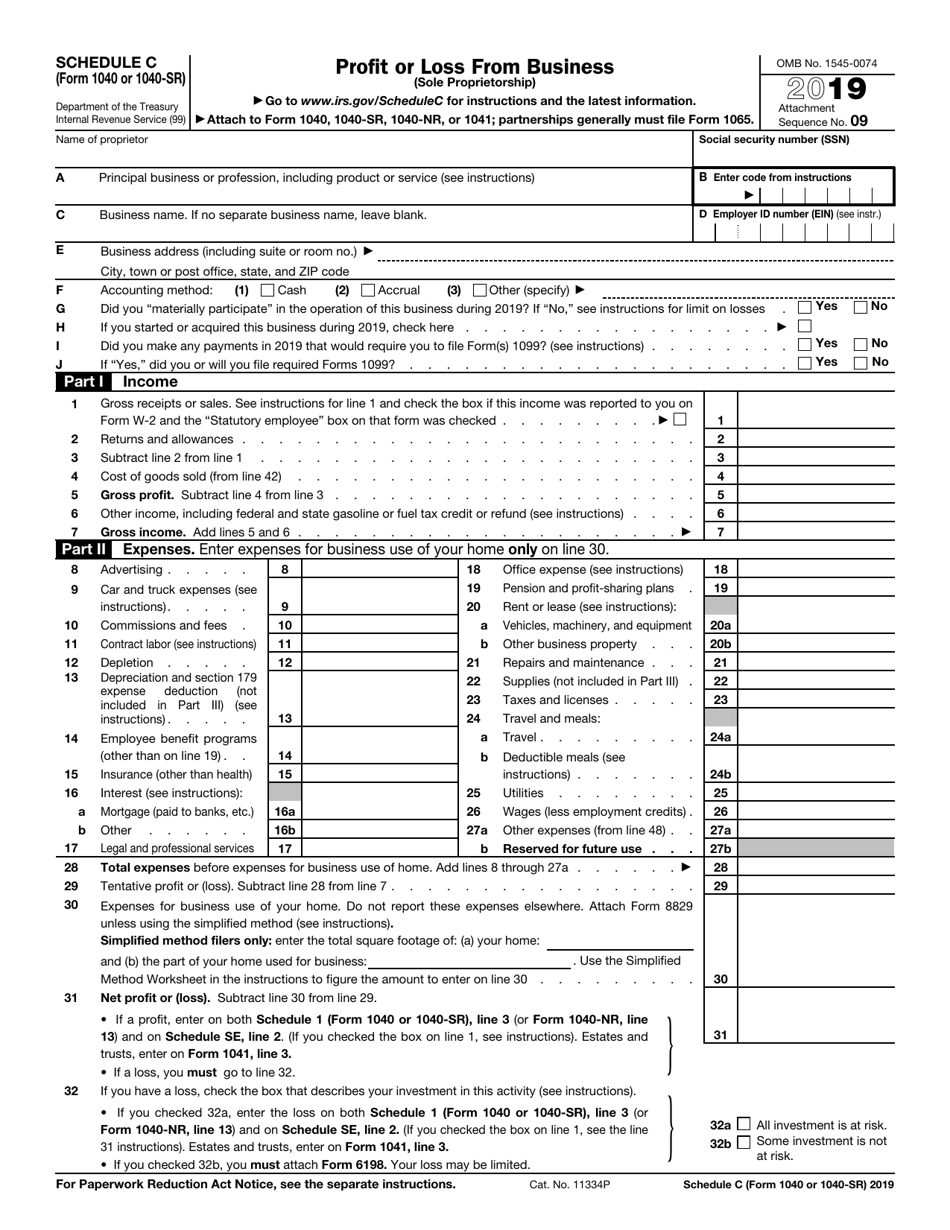

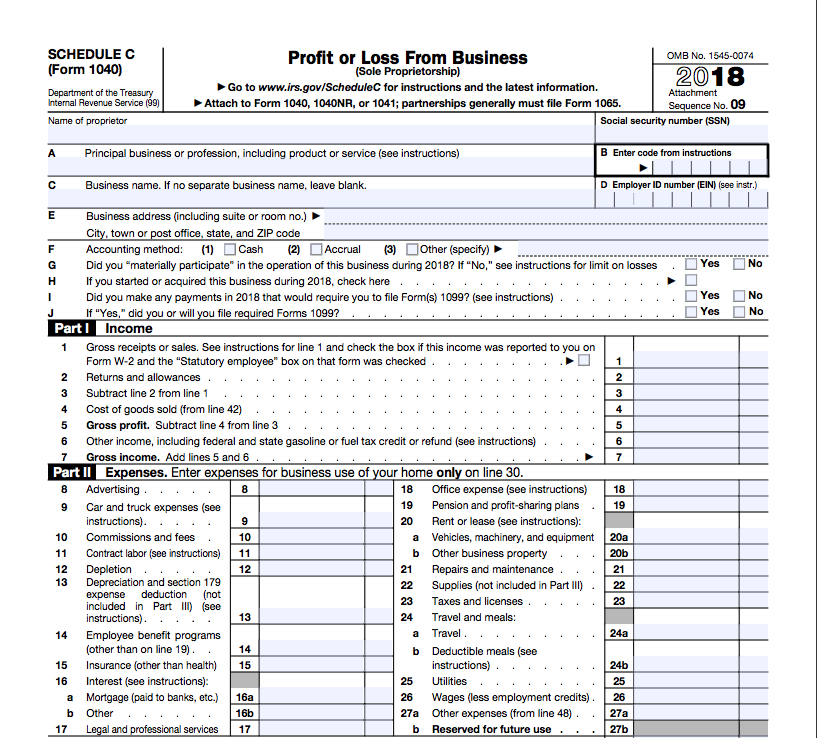

1099 schedule c form 2019

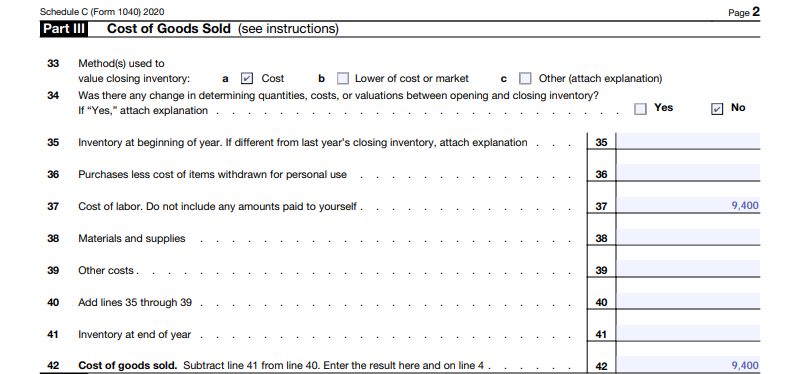

1099 schedule c form 2019-To report income from a nonbusiness activity, see the instructions for Form 1040, line 21, or Form 1040NR, line 21 Also use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain income shown on Form 1099MISC, Miscellaneous Income If I got a 1099 do I have to file schedule c It depends on which Box of the 1099MISC the income is reported If you have "Nonemployee compensation" (Box 7 of a 1099MISC),

4 Tax Programs To File Self Employed Taxes Online For Less Than 100 Careful Cents

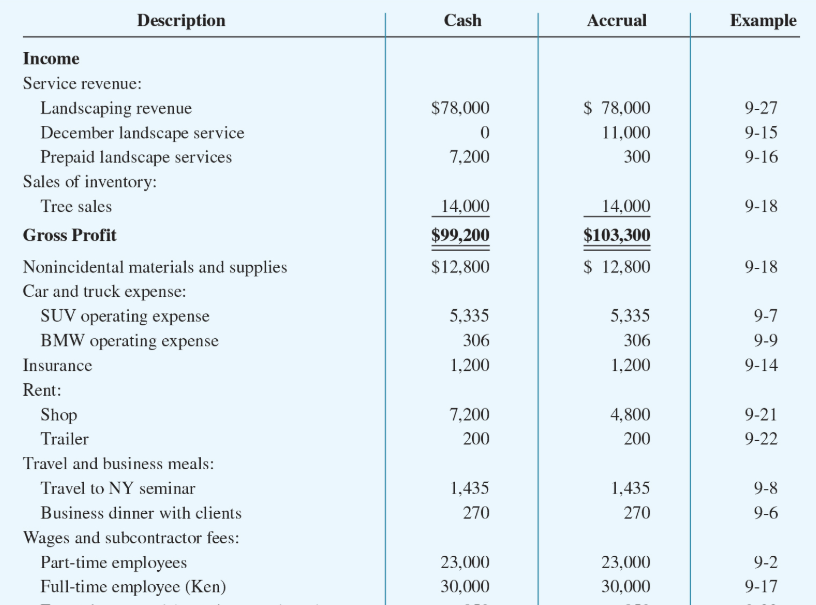

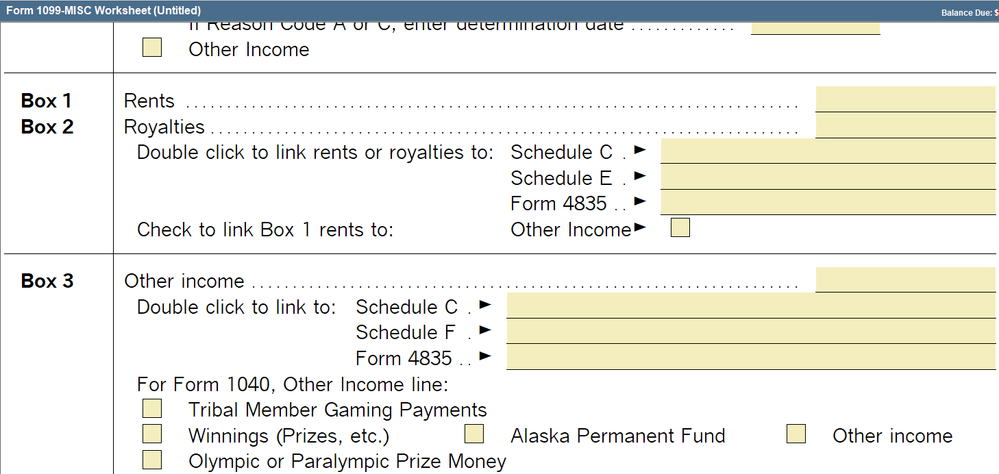

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21If you have multiple Schedule C forms and multiple 1099M/1099NEC forms, make sure you enter the correct MFC (Multiform Code) In the example below, the florist would be MFC 1, landscaping MFC 2, and woodworking MFC 3 Delete the additional Schedules C that were generated incorrectly by the 99M/99N screen (s)On the screen titled What schedule or form should the income on this Form 1099MISC be reported on?, assign the Form 1099MISC to the applicable Schedule C or Schedule E (if you have not yet completed Schedule C and/or E, you will need to do this first in order to assign the Form 1099MISC) from the Assigned schedule or form drop down menu

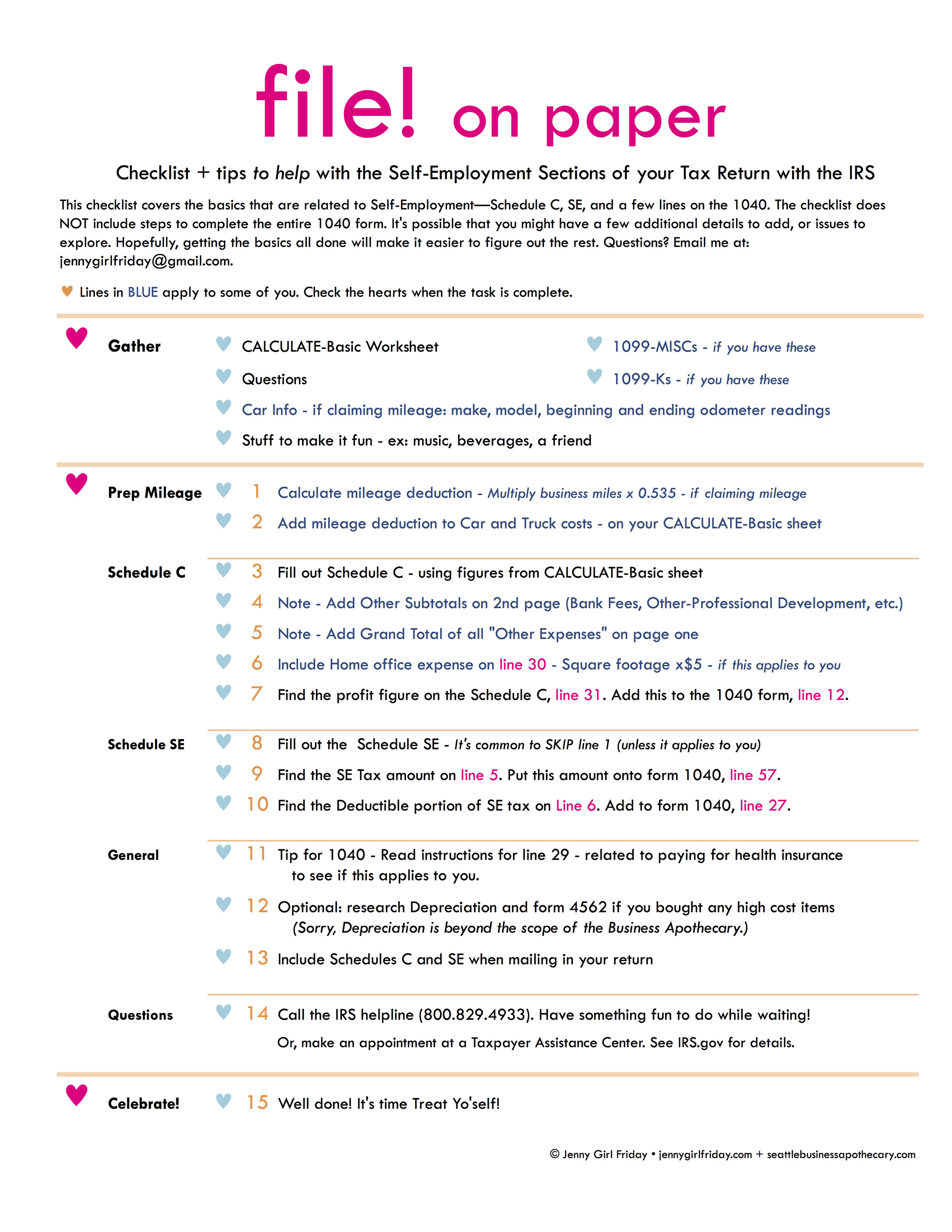

Using TaxAct When filing a 1040 for sole proprietorship this is how to file everything so you can get the pdf that you need to submit your application Doin Answer Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship) Also file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment incomeClick Create a New Schedule C to carry the income from Form 1099Misc If you already have a Schedule C, click the three dots to the right of the Schedule C to carry the income to the existing Schedule C The program will calculate the applicable selfemployment tax you will be subject to, based on the information provided in your Schedule C

Which form reports salary payments made to employees?Form 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines Schedule C is your friend if you have 1099MISC income This is the Profit or Loss from Business form First enter the total of all your 1099 income on the form, including any selfemployment income for which you did not receive a Form 1099

Freelancers Meet The New Form 1099 Nec

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Form 1099MISC, Miscellaneous Income Taxpayers may receive other business income on Form 1099MISC, Boxes 2 and 3 Refer to Schedule C instructions for more information Form 1099K, Payment Card and Third Party Network Transactions Form 1099K is used by thirdparty networks (such as Visa, Mastercard, or others) to report transactionsBeside this, where does 1099 Misc go on tax return?Form 1099 Nec Schedule C Video Bokep Indo Terupdate Nonton Dan Download Video Bokep Indo form 1099 nec schedule c Video Bokep ini adalah Video Bokep yang terkini di October 21 secara online Film Bokep Igo Sex 169,903 Bokep

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

1

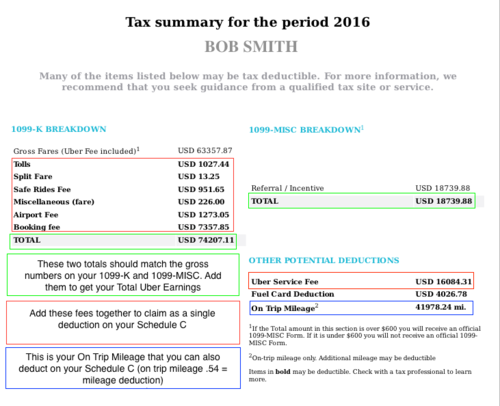

Because you received a 1099K, this is considered a Business and filing a Schedule C is required The good news is that you can claim Expenses against the income reported on your 1099K Type 'schedule c' in the Search area, then click on 'Jump toPartnerships generally must file Form 1065 OMB No Attachment 09Which tax form is used to calculate the

1099 Misc And Schedule C Intuit Accountants Community

Jenny Girl Friday Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

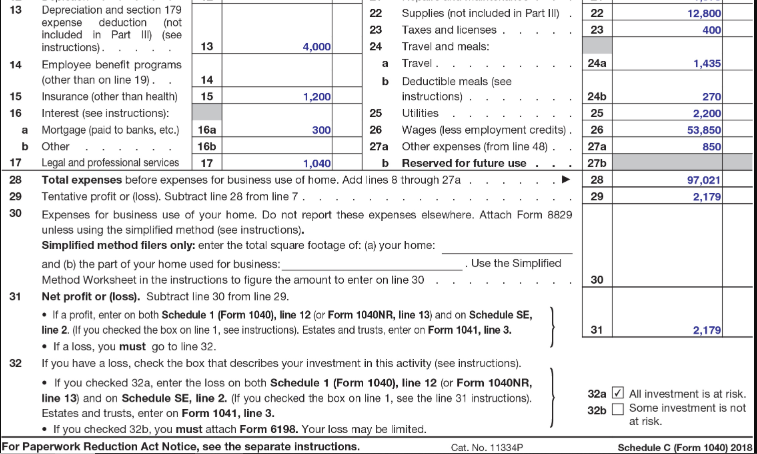

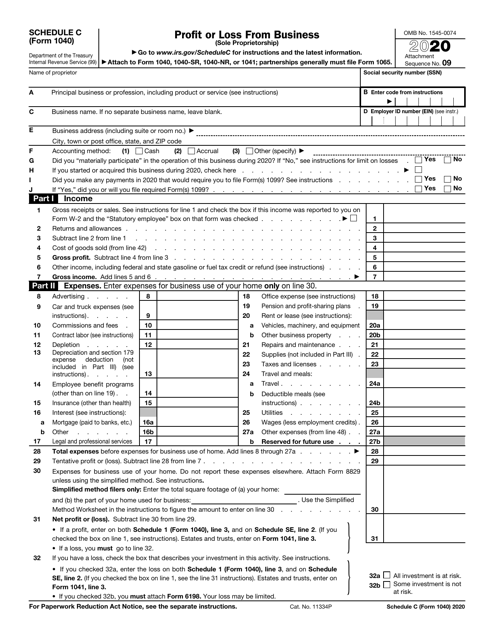

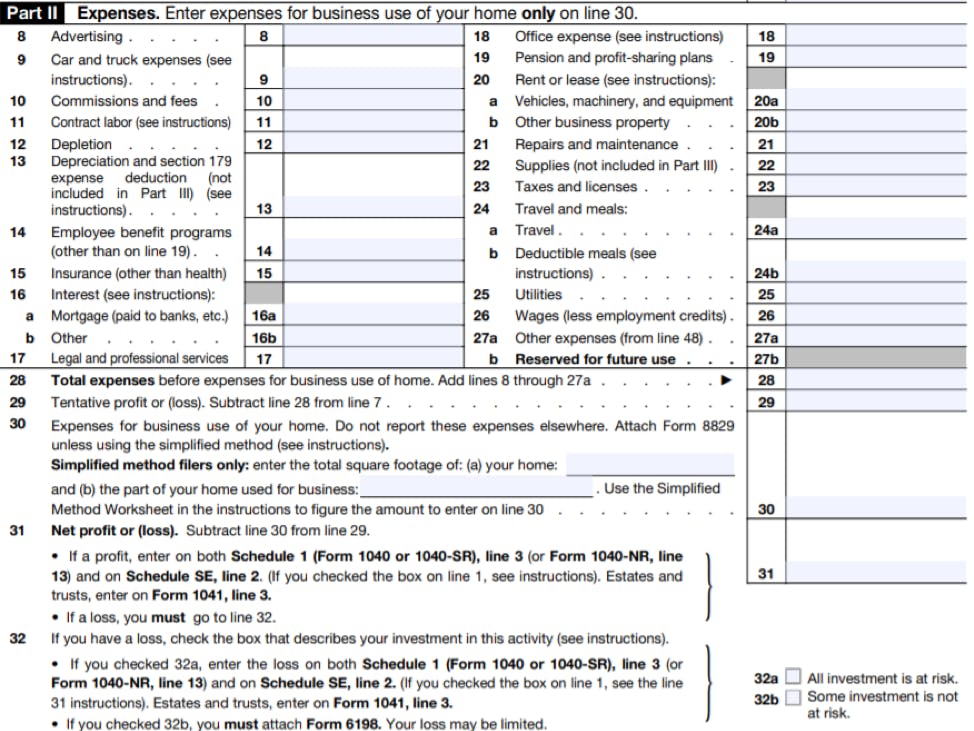

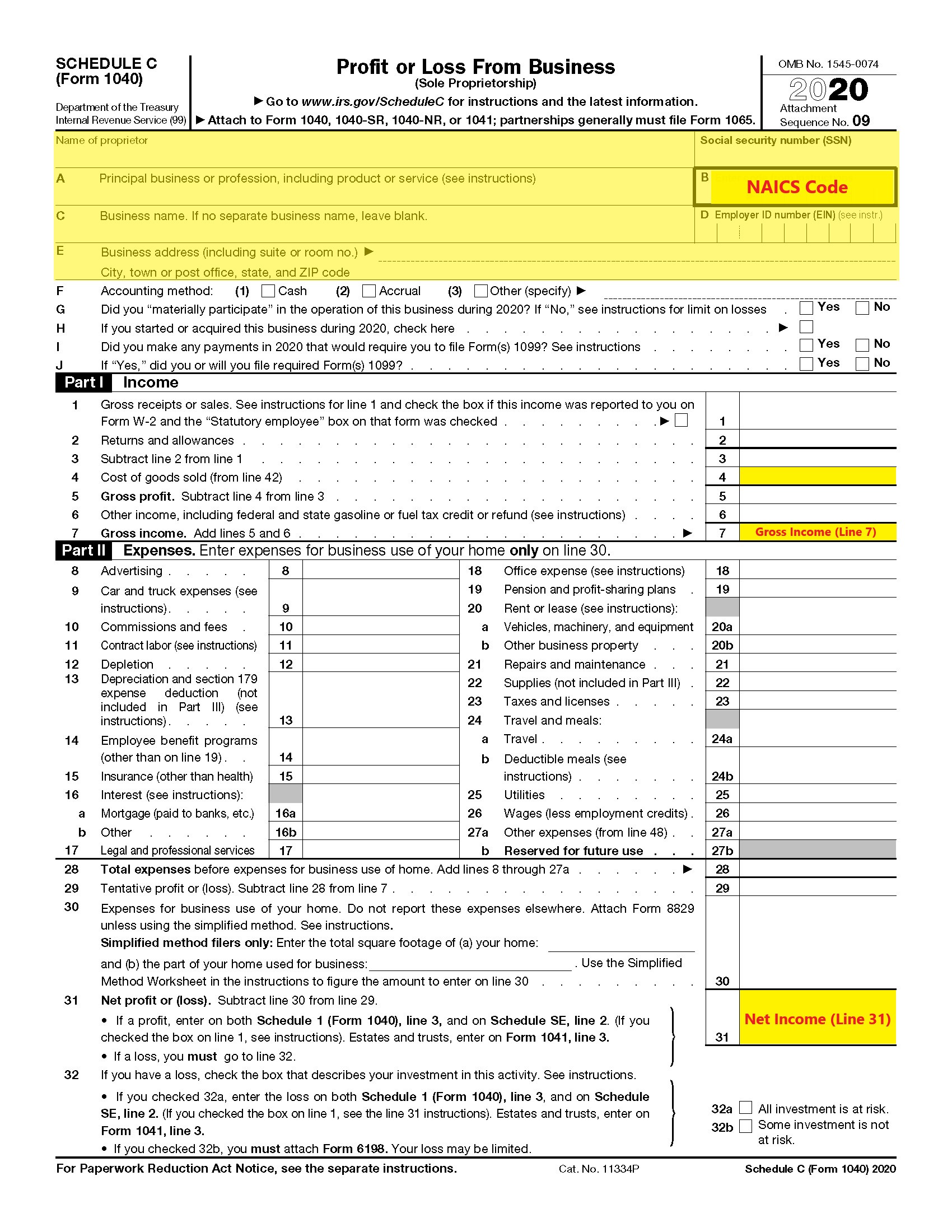

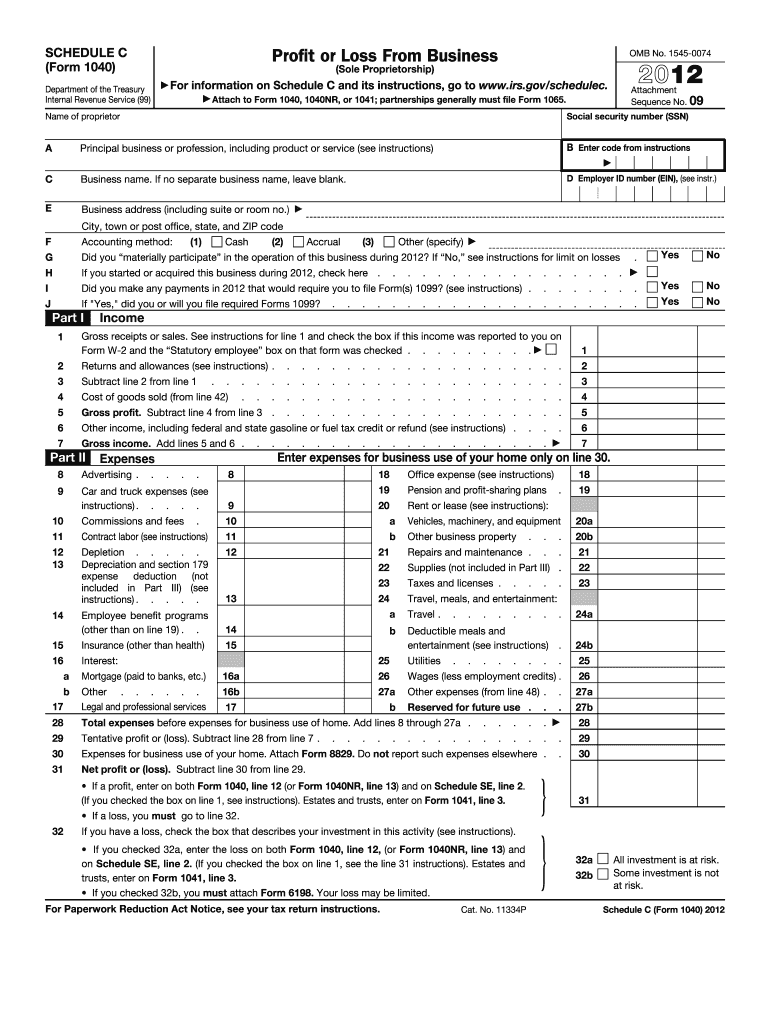

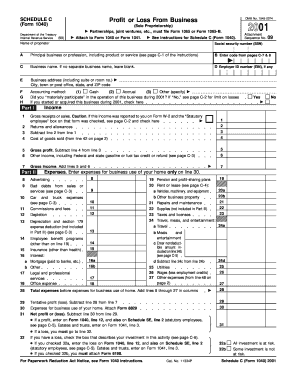

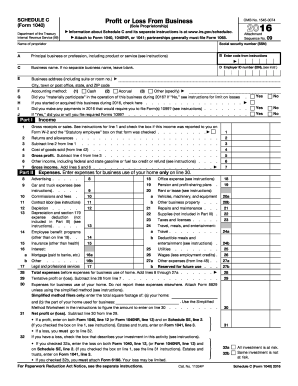

SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc ProWeb – Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21

1099 Nec Conversion In

1099 Nec Schedule C Won T Fill In Turbotax

How to enter Form 1099NEC on a tax return (Schedule C) Generally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not yourIf you, as an independent contractor, have registered yourself as a company with a single member as in, an LLC/Sole Proprietor, then your income is reported on a schedule C form You need to remember to add your 1099 income to all your other revenue sources and mention it If you are selfemployed, it's likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business This form, headlined "Profit or Loss From Business (Sole Proprietorship)," must be completed and included with your income tax return if you had selfemployment income In most cases, people who fill out Schedule C will also have to fill

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Schedule C and 1099 are two completely different forms Schedule C is the tax form you file with your income taxes that reports your income and expenses for your business 1099 is what a business may issue an independent contractor when they pay them over $600 It simply reports to the IRS how much they paid the contractor 1099 forms used by payers to report payments made to a taxpayer (or recipient) The most popular 1099 form is the 1099MISC which is used to report payments of $600 or more that were paid by the payer to a recipient Schedule C, which is sent with Form 1040, is used to report selfemployment income and calculate taxable profitIf you are filing a 1099NEC with income in Box 1, you will be prompted to add the income to an existing Schedule C or create a new Schedule C after completing the 1099NEC entry If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C

Please Complete The Tax Return For Carrie With The Chegg Com

Tax Documents That Every Freelancer And Contractor Needs Form Pros

With 1099MISC income, you will need to file a Schedule C or Schedule CEZ (if you are filing 1040EZ) It is also on this form that you will list your deductible business expenses It is extremely important that you document all business expenses with receipts and notations in some sort of book (or computerized records)Independent contractors report their income on Schedule C (Form 1040 or 1040SR), Profit or Loss from Business (Sole Proprietorship) Also file Schedule SE (Form 1040 or 1040SR), SelfEmployment Tax if net earnings from selfemployment are $400 or more What happens if I don't file my 1099 Misc?Module 14B Simulation Using Form 1099MISC to Complete Schedule CEZ, Schedule SE, and Form 1040 In this simulation, you will take on the role of James King in order to learn how to claim selfemployment income

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Irs Form 1040 Schedule C And Form 1099 21 Individual Income Tax Changes Child Tax Credit And Expansion

We will go through Form 1099 and Schedule C of Form 1040 (sole proprietorship tax returns) in detail to clear up all uncertainties filers may have Topics Discussed in the SessionChanges pertaining to sole proprietors, including FFCRA credits, changes to Form 1099, and reporting business losses on personal returnsForm 1040 Schedule C 21Which form reports payments made to independent contractors?Form 1099A Acquisition or Abandonment of Secured Property (Info Copy Only) 19 Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) 21 Form 1099B

Form 1099 Nec Nonemployee Compensation 1099nec

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

SCHEDULE C (Form 1040 or 1040SR) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;C Form 1099 Fill out, securely sign, print or email your 1099c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aIndependent contractors (also known as 1099 contractors) use Schedule C to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or

19 Schedule C Form 1040 Or 1040 Sr Willow Wade Pdf Schedule C Form 1040 Or 1040 Sr Profit Or Loss From Business Go Omb No 1545 0074 19 Sole Course Hero

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form, it is used to provide information about both the profit and the loss sustained in business by the sole proprietor This form includes information about income for the business and its various expensesIf you had not yet completed Schedule C (Form 1040) Profit or Loss From Business or Schedule E (Form 1040) Supplemental Income and Loss, you will need to do so before you can assign the applicable Form 1099MISC Miscellaneous Information To enter or review the information from Form 1099MISC From within your TaxAct return (Online or Desktop), click FederalBusiness 1099 Form / Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040 / Kent thune is the mutual funds and investing expert at the balance You must have 1099 forms issued to you to prepare tax returns and prove income you receive to lenders, financial reviewers and some employers

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship Templateroller

Ppp Faqs 1040 Schedule C Tips For Independent Contractors Sole Proprietors And Self Employed

If including on Schedule C or Form 45, don't enter the 1099MISC here but enter it directly on the schedule or form Royalties 2 2 C, E Royalties from oil, gas, or mineral properties, copyrights, and patents (Oil or gas payments for a working interest are reported on Schedule C Click the "Sch C" check box to link to Schedule C) OtherD16 Connecting the Form 1099NEC to Schedule C Note If there is more than one Form 1099NEC for the same business, ensure that they are all linked to the same Schedule C Select the edit icon for the first Schedule C to add the additional Form 1099NEC to it Note If the Form 1099NEC income is selfemployment, create a Schedule C by selecting the The Schedule CEZ is a shorter version of the Schedule C form It's shorter because it skips some of the less common sections or additional forms of the Schedule C that take a bit longer to fill outfor example, the depreciation or home office deduction forms You can file the Schedule CEZ if you Had business expenses of $5,000 or less

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

About Schedule C Form 1040 Profit Or Loss From Business Sole Proprietorship Internal Revenue Service

Partnerships generally must file Form 1065 OMB No 19

What Is Form 1099 Nec For Nonemployee Compensation

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

1040 Erroneous Schedule C

Schedule C On Turbo Tax Software Question Uber Drivers Forum

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

What Is An Irs Schedule C Form And What You Need To Know About It

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

1099 Misc Form Fillable Printable Download Free Instructions

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

What Do The Income Entries On The Schedule C Mean Support

Re 1099 Misc Income Doesn T Appear On Schedule C

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Schedule C Multiple 1099 Misc 1099 Nec For Same Business 1099m 1099nec Schedulec

Fill W2 941 1099 940 1040 Schedule C Tax Form By Tax Services Fiverr

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Form 1099 Nec Nonemployee Compensation 1099nec

Free 9 Sample Schedule C Forms In Pdf Ms Word

Irs Form 1099 Misc

How A Form 1099 C Affects Taxes Innovative Tax Relief

Step By Step Instructions To Fill Out Schedule C For

1

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

How Do I Link To Schedule C On My 1099 Misc For Bo

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

2

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Form 1099 Nec For Nonemployee Compensation H R Block

4 Tax Programs To File Self Employed Taxes Online For Less Than 100 Careful Cents

Ppp Second Draw Application Tutorial Self Employed Schedule C 1099 No Employees Homeunemployed Com

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

1040 Schedule C 21 Schedules Taxuni

Schedule C An Instruction Guide Craftybase

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

How To Fill Out Schedule C For Business Taxes Youtube

Freelance Taxes Income Taxes Arcticllama Com

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)

Irs Schedule C What Is It

What Is The Difference Between Schedule C And Schedule C Ez Slide Share

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

Step By Step Instructions To Fill Out Schedule C For

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

Walk Through Filing Taxes As An Independent Contractor

Schedule C Pdf Fill Online Printable Fillable Blank Pdffiller

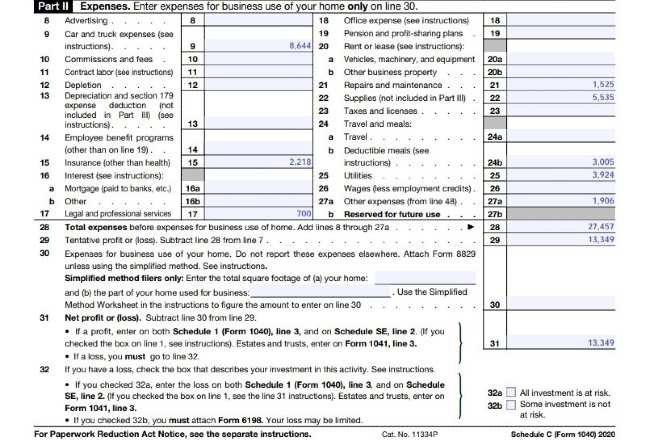

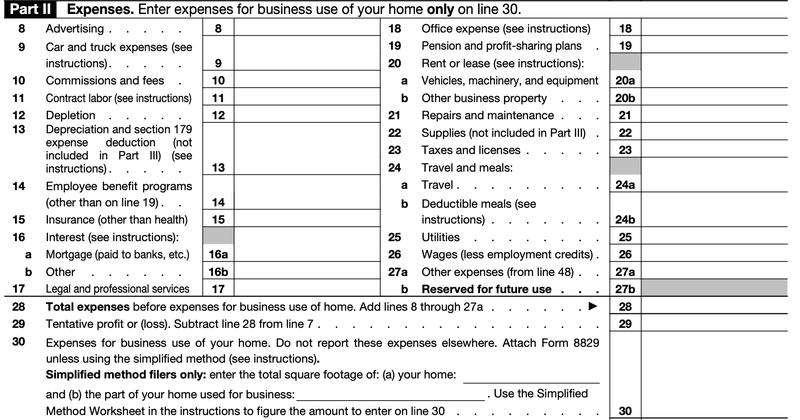

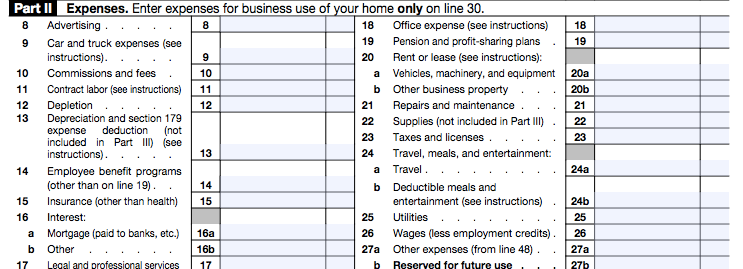

What Do The Expense Entries On The Schedule C Mean Support

Uber Tax Filing Information Alvia

How To File Schedule C Form 1040 Bench Accounting

Understanding Taxes Simulation Simulation Using Form 1099 Int To Complete Schedule C Ez Schedule Se And Form 1040

Sample 1040 Schedule C Filled Out Fill Out And Sign Printable Pdf Template Signnow

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Indie Authors Should Consider Using Schedule C Irs Tax Forms Tax Forms Irs Taxes

Self Employed Vita Resources For Volunteers

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Walk Through Filing Taxes As An Independent Contractor

What Is A Schedule C Stride Blog

Schedule C 1099 Misc Youtube

1

18 21 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

1

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

It S Only 1 300 Do You Really Have To Send Me The 1099 Taxable Talk

Schedule C Launch Consulting

2

Step By Step Instructions To Fill Out Schedule C For

What Is A Schedule C Tax Form H R Block

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Do The Expense Entries On The Schedule C Mean Support

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

0 件のコメント:

コメントを投稿