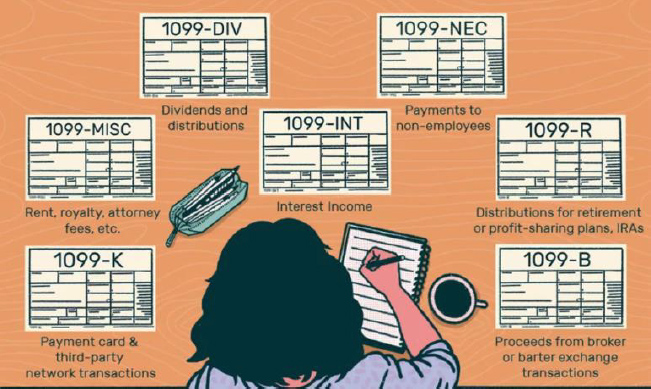

Your Form 1099 Composite may include the following Internal Revenue Service (IRS) forms 1099DIV, 1099INT, 1099MISC, 1099B, and 1099OID You'll only receive the form(s) that apply to your particular financial situation;1099MISC and 1099NEC Substitute payments in lieu of dividends may be reported on a composite statement to the recipient with Form 1099DIV See Pub 1179 3 Payments made to certain payees These include a corporation, taxexempt organization, any IRA, Archer MSA, health savings account (HSA), US agency, state, theFeb 01, 19 · Form 1098, Form 1099, Form 5498 or Form W2G Make a new information return Enter "X " in the "CORRECTED" box at the top of the form Include date, which is optional Enter all the correct information including the correct TIN, name and contact address Form 1096 Make a new transmittal Form 1096

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Composite form 1099 cash app

Composite form 1099 cash app-Reduced confusion, given that you will likely receive one tax form instead of potentially receiving multiple versions Being able to plan for taxreturn preparation based on knowing when you will receive final tax data from SPTC The 1099 Composite includes the following 1099File Form 1099MISC for each person to whom you have paid during the year At least $10 in royalties or broker payments in lieu of dividends or taxexempt interest At least $600 in Rents Prizes and awards Other income payments Medical

Quickbooks 1099 Misc 3 Part Pre Printed Tax Forms With Envelopes

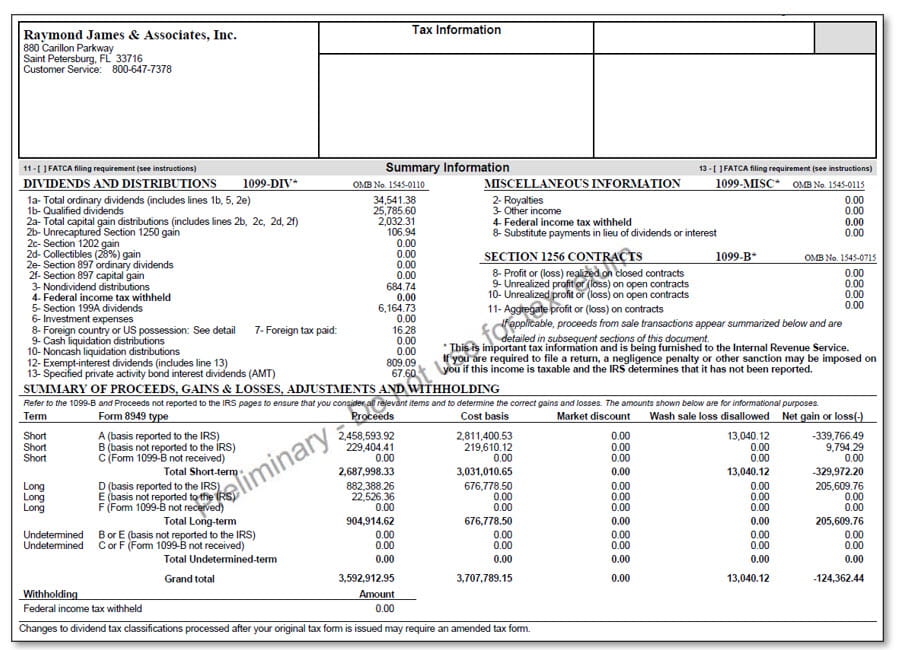

Feb 26, 21 · Understanding the boxes on Form 1099B Most taxpayers rely on Form 1099B to report stock and other investment trades Taxpayers who use large online brokers are most likely to find this information on a 1099 combination statement with Forms 1099INT and 1099DIV which summarizes all reportable investing activity within the same firmThe Form 1099DIV is an IRS form that reports the aggregate amount of dividends and other distributions you receive during the year when a stock or mutual fund pays income Forms will only be generated if the aggregate amount of dividend income on the Form 1099 DIV exceeds $10 19 TATEMENTCOMPOSITE STATEMENT OF 1099 FORMS 18 TATEMENT inf brochur repr underst curr t regar inf r R 2 epresentativ o ec of or ormation TABLE OF CONTENTS Overview 3 Composite Statement Mailing Groups 4 Changes for 18 5 • Form 1099DIV 5 • Mutual Funds and UIT Supplemental Tax Detail 5 Composite Statement Overview and Instructions 6 • Form

You will receive Form 1099DIV reporting information on Composite Form 1099 if you received $10 or more in dividends or other distributions from your fund during the calendar year While amounts less than $10 are still required to be reported to the IRS on your tax return, the IRS does not require a 1099DIV to be issuedIn most cases, a 1099B form provides information about securities or property involved in a transaction handled by a brokerApr 09, 21 · They might issue Form 1099B as well, or include all this information on a "Composite 1099 Form" These composite forms are sometimes lacking critical information, so you might want to ask a tax professional for help if you receive one Form 1099B Summary

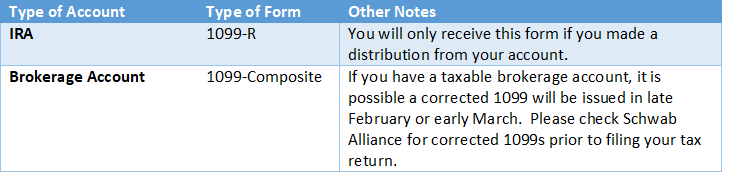

IRS Form 1099R reports a taxpayer's distributions from pensions, annuities, IRAs, insurance contracts, profit sharing plans and other employer sponsored retirement plans You may receive more than one IRS form 1099R, because distribution information on each form is limited to one account and one distribution codeTo have forms mailed to you, please call (401) ;Checked, the payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You may also have a filing requirement See the Instructions for Form 38 Applicable checkbox on Form 49 Indicates where to report this transaction on Form 49 and Schedule D (Form 1040), and which checkbox is applicable

How To Report Section 1256 Contracts Tastyworks

How You Will Receive Your 1099

Feb 13, · 1099 Composite Help So you received your tax documents from your broker or financial advisor either online or in a fat envelope in the mail You open it up and it is page after page of tables and footnotes with labels and numbers, and you wonder how you are ever going to make heads or tails of itAs the tax reporting requirements for brokerdealers have evolved, so has Cetera's 1099 Composite form The following pages provide a break down of our Form 1099 and the various components that make up the composite data Each section of our 1099 Composite form is represented, with a brief explanation of the contentsCall 07 Chat Professional answers 24/7 Visit Find a Schwab branch near you Important Disclosures Investing involves risk, including loss of principal The information provided here is for general informational purposes only

Major Changes To File Form 1099 Misc Box 7 In

A Guide To Your Composite Statement Of 1099 Forms Mailing Schedule Form Overview Filing Information Pdf Free Download

About the Composite 1099 Tax Statement We Prepare for You IRS regulations permit us to roll up several of your tax statements into one consolidated form – The Composite 1099 Tax Statement (the Statement _) The Statement is a permitted substitute for official IRS forms and also includes supplemental informationApr 02, 21 · Form 1099NEC was introduced under former President Ronald Reagan's administration in the 1980s, and it was a very simple form The main part was a box for you to report any money you earned1099 Informatio uide 1099 Information Guide 2 Your Consolidated Form 1099 is the authoritative document for tax reporting purposes Due to Internal Revenue Service (IRS) regulatory changes that have been phased in since 11, TD Ameritrade is now required (as are all brokerdealers) to report adjusted cost basis, gross proceeds, and the holding

Composite Form 1099 Cashapp

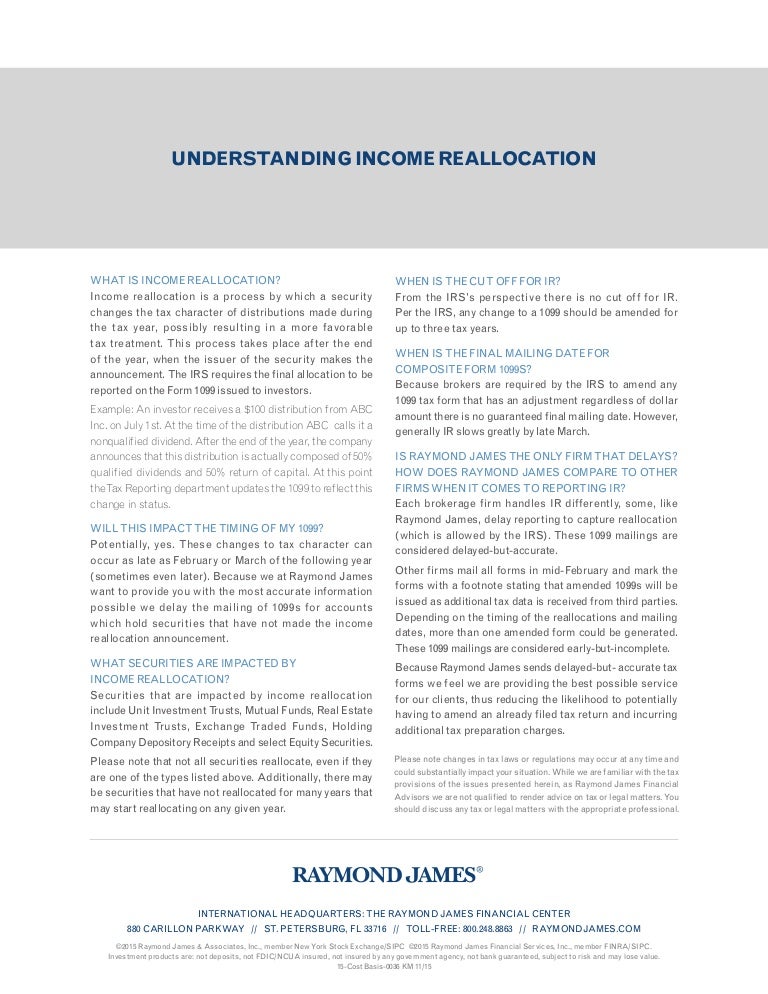

15 Cost Basis 0036 Reallocation 11 15 Final

Most forms now contain a 1D barcodeApr 27, 17 · 1099MISC This is the form that your business will usually use, and is issued to your contractors or other nonemployees 1099DIV If you own stock and you receive over $10 in payments, you'll need to file a 1099DIV 1099INT You'll receive this if a financial institution has paid you more than $10 in interest in a calendar year (LuckyFeb 26, 19 · A 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of a

A Guide To Your Composite Statement Of 1099 Forms Mailing Schedule Form Overview Filing Information Pdf Free Download

Making A Fillable 1099 Misc Pdf For Printing Creativepro Network

Tax documents available electronically include the IRS Composite Form (1099B, DIV, INT, MISC, OID) and IRS Forms 1099R, 5498 and 1099Q Tax Form 1099 Export to Excel Raymond James, in conjunction with our tax vendor, offers the ability for clients toThe Tax Reporting Information Statement, Form 1099, is a record of activity in your account at Janney Montgomery Scott LLC This statement provides a comprehensive record of reportable income and securities transactions posted to your Janney account during the taxable year The information provided by Janney on Form 1099 will be reported to theIndex Fund Advisors, Inc (IFA) is a feeonly advisory and wealth management firm that provides riskappropriate, returnsoptimized, globallydiversified and taxmanaged investment strategies with a fiduciary standard of care Founded in 1999, IFA is a Registered Investment Adviser with the US Securities and Exchange Commission that provides investment advice to individuals, trusts

Tax Form 1099 Information

1099 Availability Sei

Mar 11, 21 · 1099R You will receive this form if you received a distribution of $10 dollars or more from a retirement account Consolidated 1099 This form is used to assist you in filing your income tax return This form will provide 1099B from broker transactions, 1099DIV for dividends, and 1099INT for interestJun 14, 17 · Form 1099 The 1099 form is a common one that covers several types of situations Depending on what's happened in your financial life during the year, you could get one or more 1099 tax form "types" or even more than one of the same types of 1099Items listed below can be sorted by clicking on the appropriate column heading;

Why No 1099 For Short Term Capital Gains From Stocks Personal Finance Money Stack Exchange

What Is Form 1099 B Proceeds From Broker Transactions Turbotax Tax Tips Videos

Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,Your Form 1099 The Basics The 1099 form, by contrast, records income you received as an independent contractor or for some other source of incomeFor example, if you're a freelancer or own your own business, you'll likely receive several 1099 forms from your clients The IRS requires businesses to issue a form 1099 if they've paid you at least $600 that yearJan 11, 18 · Many investors will need to fill out Form 49 in addition to Schedule D, most often because some or all of the transactions from their 1099B did not have their basis reported to

/10167119-F-56a938623df78cf772a4e2f5.jpg)

Report 1099 A And 1099 B Data On Your Tax Return

Quickbooks 1099 Misc 3 Part Pre Printed Tax Forms With Envelopes

Apr 28, 21 · Passthrough Entities and Composite Return Tax Forms All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format;Mar 26, 19 · A 1099 form is a tax form that reports income, including investment income, to you and the IRS Here's how to use it when filing your taxes and what's changed in 18Jan 31, 19 · I just received Form 1099 Composite and/or Year End Summary documents, prepared on JANUARY 25, 19, i sold a few very small shares that i bought this year 19 the timing doesn't matter as i had the for a week and decided to sell them for a better stockBut the bulk of my stocks which was bought in Oct 18 i still held on to i only sold one stock which was

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Why No 1099 For Short Term Capital Gains From Stocks Personal Finance Money Stack Exchange

However, transactions are listed as long termHowever, some of this amount may be taxable depending on how you spend theTaxAct® will complete Form 49 for you and include it in your tax return submission To get the transaction information into your return, select from the 6 options described below #1 Enter transactions on Form 1099B Create a Form 1099B in TaxAct for each transaction listed on your statement To enter Form 1099B into the TaxAct program

How To Prepare For The New Form 1099 Nec

Tax Prep Tips 1099 Tracking Reporting Bogart Wealth

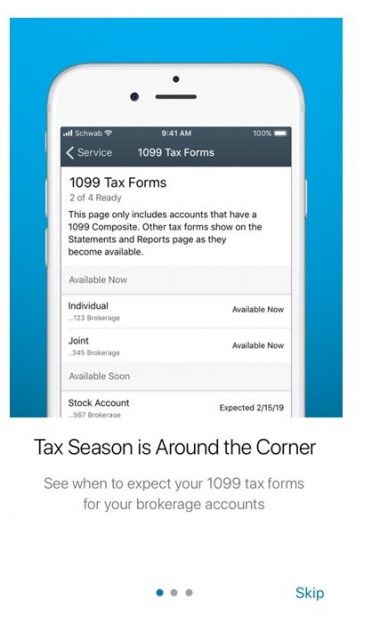

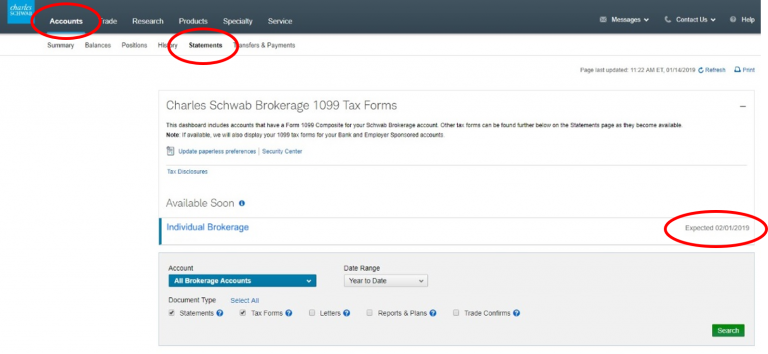

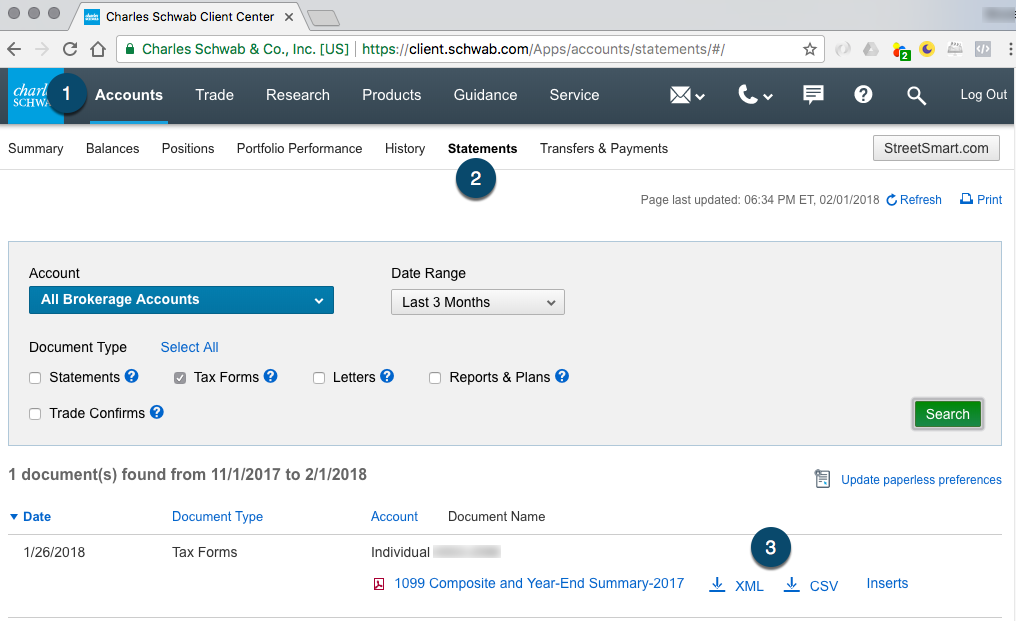

See them all on your 1099 dashboard Log in Need more help with your Schwab forms or financial planning?Check the box if you are a US payer that is reporting on Form(s) 1099 (including reporting payments in boxes 1, 3, 8, 9, and 10 on this Form 1099INT) as part of satisfying your requirement to report with respect to a US account for chapter 4 purposes, as described in Regulations section (d)(2)(iii)(A)The Form 1099DIV is an IRS form that reports the aggregate amount of dividends and other distributions you receive during the year when a stock or mutual fund pays income Forms will only be generated if the aggregate amount of dividend income on the Form 1099 DIV exceeds $10

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Cost Basis Facts For Stock Plan Participants How To Avoid Overpayment Pdf Free Download

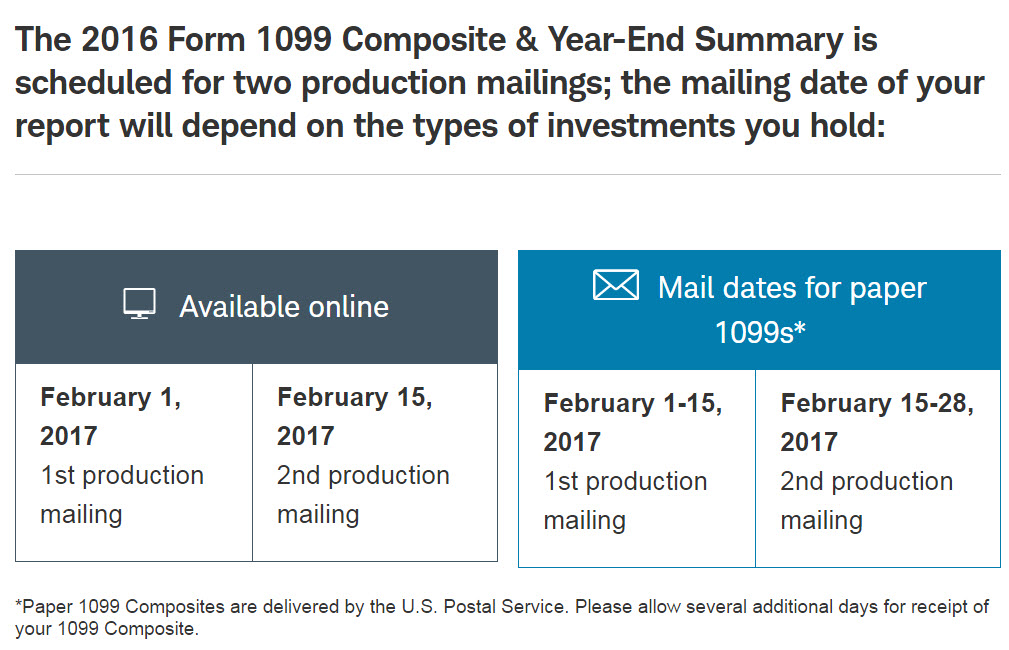

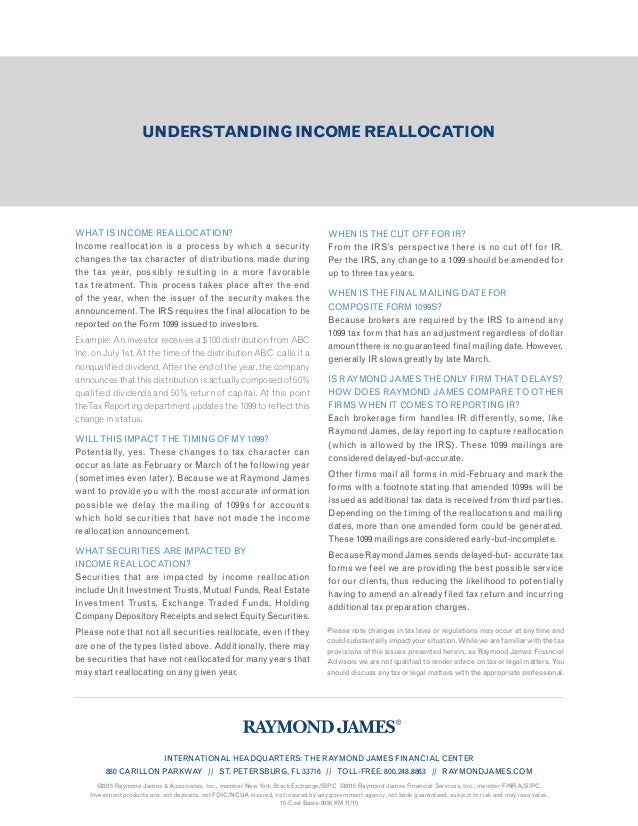

Form 1099 Composite mailing dates In order to provide your Form 1099 Composite as early as possible, and to reduce the number of corrected forms, we'll have two mailing dates for the 12 tax year The date your Form 1099 Composite is mailed depends on the types of investments you hold Form 1099 Composite for accounts that include onlyComposite Form 1099 3 Combines Forms 1099DIV and 1099B reporting for nonretirement accounts into one form Form 1099DIV Reports total ordinary, qualified, and taxexempt interest dividends, total capital gain distributions, unrecaptured Section 1250 gain, federal income tax withheld, foreign tax paid, foreign source income, return ofJun 04, 19 · Your form 1099 composite is simply multiple forms in one document You will take each form and enter it as if it were distributed on its own You likely have a 1099INT, and a 1090DIV You may also have a 1099B, 1099OID and a 1099MISC included in the statement

What Happens If I Get An Incorrect 1099 The Motley Fool

Email Template

Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kindsMar 17, · 1099 Composite Statement 0317, 0942 AM 1099 Composite form shows assets sold that were held less than one year;A common reason for receiving a 1099DIV form is because some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains distribution to you during the year You won't file the 1099DIV with the Internal Revenue Service, but you will need the information it reports when preparing your tax return

16 Tax Form Availability Dates Apriem

A Comprehensive Guide To Your Composite 1099 Tax Statement Pdf Free Download

Introduction If you contribute money to a qualified tuition program, such as a 529 plan or a Coverdell ESA, you will likely receive an IRS Form 1099Q in each year you make withdrawals to pay school expenses of the beneficiary The 1099Q reports the total of all withdrawals you make during the year;Form 1099R, Bank Form 1099INT and Employer Sponsored 1099 tax forms can also be found in your dashboard Other tax forms (eg, Form 5498, Form 1099MISC) can be found on the Statements page You can also access your 1099s via the Schwab Mobile App by tapping More on the bottom of the screen, then tap Client Service Menu, and then select theDec 27, · The composite 1099 will actually have the 3 main kinds of 1099 on it, 1099Div, 1099Int and 1099B for sales It is one page with the 3 sections on it There might be backup detail sheets listing the individual transactions You do need to enter any sales separately

Important Tax Information 18 Level Financial Advisors

Thick Composite Structures Under A Load Pinch Scientific Net

The Composite Form 1099 will list any gains or losses from those shares If you did not sell stock or did not receive at least $10 worth of dividends, you will not receive a Composite Form 1099 for a given tax year If you're looking for specific information about your tax filing, please reach out to a qualified tax professionalComposite Form 1099 3 Combines Forms 1099DIV and 1099B reporting for nonretirement accounts into one form Form 1099DIV Reports total ordinary, qualified, and taxexempt interest dividends, total capital gain distributions, unrecaptured Section 1250 gain, federal income tax withheld, Section 199A dividends, foreign tax paid, return ofPlease keep them for your records Please note that information in the YearEnd Summary is not provided to the IRS

How To Read Your Brokerage 1099 Tax Form Youtube

Don T Overpay Your Taxes Learn The Cost Basis Facts For Stock Plans Pdf Free Download

Form 1099 Composite And Year End Summary Charles Schwab

Chevy Chase Trust Account Information

Schwab S Revised Form 1099 Composite Charles Schwab

What Kind Of Form In A 1099 Composite I Believe This Is Cap Gains Tax

A Comprehensive Guide To Your Composite 1099 Tax Statement Pdf Free Download

Cost Basis Legislation And Tax Reporting Charles Schwab

How You Will Receive Your 1099

Earn Interest In 18 Get To Know Form 1099 Int The Motley Fool

Form 1099 The Frustrations Of Form 1099 Tax Time

Schwab One Account Of Account Number Tax Year Form 1099 Composite May Include The Following Internal Revenue Service Irs Forms 1099 Div 1099 Int 1099 Misc 1099 B And 1099 Oid Pdf Document

Chevy Chase Trust Account Information

Tax Prep Tips 1099 Tracking Reporting Bogart Wealth

Tax Reporting Client Resources Raymond James

Schwab Moneywise Calculators Tools Understanding Form 1099

How To Read Your Composite And Year End Charles Schwab

Help Faqs Will Coinlist Provide Me With A 1099 B Coinlist

How To Read Your Composite And Year End Charles Schwab

Online Generation Of Schedule D And Form 49 For Clients Of Schwab

15 Cost Basis 0036 Reallocation 11 15 Final

Internal Revenue Bulletin 18 39 Internal Revenue Service

How To Read Your 1099 Robinhood

Schwab S Revised Form 1099 Composite Charles Schwab

Pdf Numerical Simulation Of Composite Hemp Fibers Behavior For Aircraft Application

Difference Between 1099 K And 1099 B Tax Forms From Cryptocurrency Exchanges Taxbit Blog

The Most Common Tax Form Questions Betterment

Uvkg2jheweyqgm

0 件のコメント:

コメントを投稿